For years, Bitcoin enthusiasts have been expecting a significant change in the value due to the involvement of institutional investors. The concept was simple: as companies and large financial entities invest in Bitcoin, the market would experience explosive growth and a sustained period of rising prices. However, the actual outcome has been more complex. Although institutions have indeed invested substantial capital in Bitcoin, the anticipated ‘supercycle’ has not unfolded as predicted.

Institutional Accumulation

Institutional participation in Bitcoin has significantly increased in recent years, marked by substantial purchases from large companies and the introduction of Bitcoin Exchange-Traded Funds (ETFs) earlier this year.

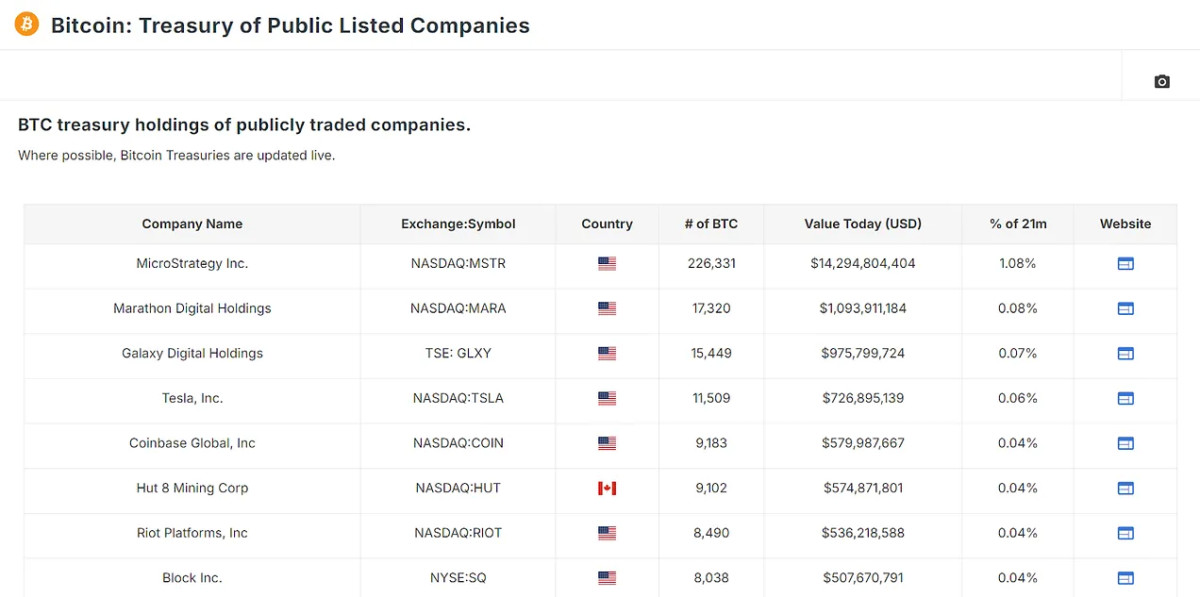

Leading this movement is MicroStrategy, which alone holds over 1% of the total Bitcoin supply. Following MicroStrategy, other prominent players include Marathon Digital, Galaxy Digital, and even Tesla, with significant holdings also found in Canadian firms such as Hut 8 and Hive, as well as international companies like Nexon in Japan and Phoenix Digital Assets in the UK; all of which can be tracked via the new Treasury data charts available on site.

In total, these companies hold over 340,000 bitcoin. However, the real game-changer has been the introduction of Bitcoin ETFs. Since their inception, these financial instruments have attracted billions of dollars in investments, resulting in the accumulation of over 91,000 bitcoin in just a few months. Together, private companies and ETFs control around 1.24 million bitcoin, representing about 6.29% of all circulating bitcoin.

A Look at Bitcoin’s Recent Price Movements

To understand the potential future impact of institutional investment, we can look at recent Bitcoin price movements since the approval of Bitcoin ETFs in January. At the time, Bitcoin was trading at around $46,000. Although the price dipped shortly after, a classic “buy the rumor, sell the news” scenario, the market quickly recovered, and within two months, Bitcoin’s price had surged by approximately 60%.

This increase correlates with institutional investors’ accumulation of Bitcoin through ETFs. If this pattern continues and institutions keep buying at the current or increased pace, we could witness a sustained bullish momentum in Bitcoin prices. The key factor here is the assumption that these institutional players are long-term holders, unlikely to sell off their assets anytime soon. This ongoing accumulation would reduce the liquid supply of Bitcoin, requiring less capital inflow to drive prices even higher.

The Money Multiplier Effect: Amplifying the Impact

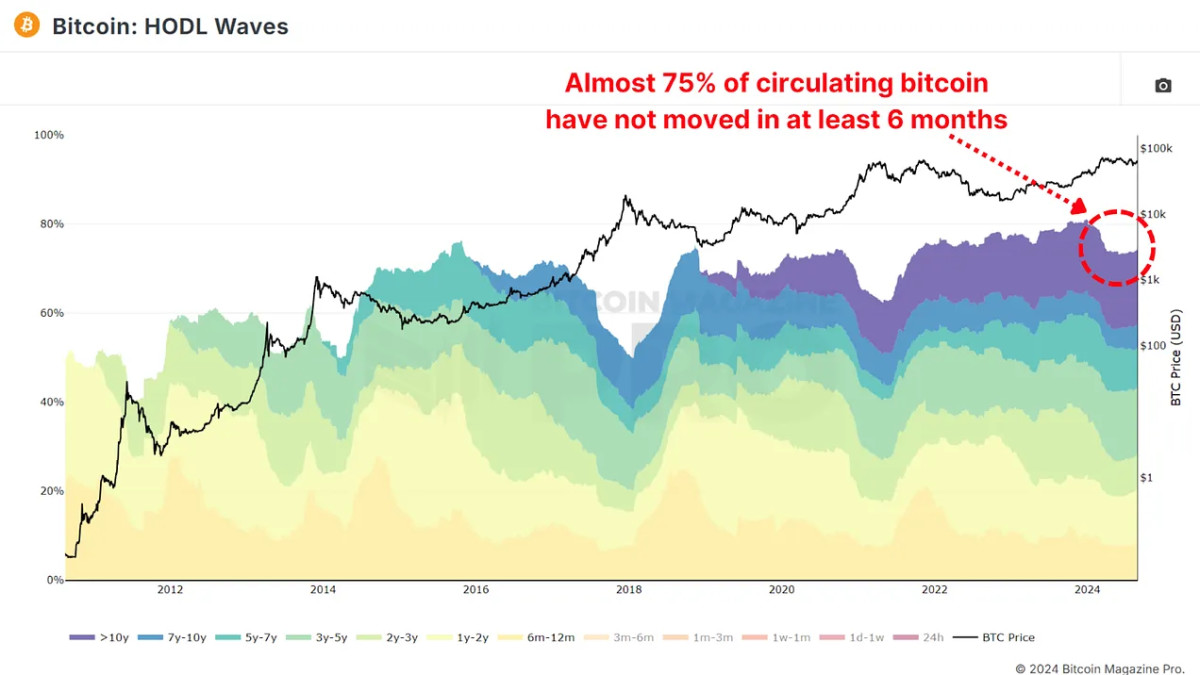

The accumulation of assets by institutional players is significant. Its potential impact on the market is even more profound when you consider the money multiplier effect. The principle is straightforward: when a large portion of an asset’s supply is removed from active circulation, such as the nearly 75% of supply that hasn’t moved in at least six months as outlined by the HODL Waves, the price of the remaining circulating supply can be more volatile. Each dollar invested has a magnified impact on the overall market cap.

For Bitcoin, with roughly 25% of its supply being liquid and actively traded, the money multiplier effect can be particularly potent. If we assume this illiquidity results in a $1 market inflow increase in the market cap by $4 (4x money multiplier), institutional ownership of 6.29% of all bitcoin could effectively influence around 25% of the circulating supply.

If institutions were to begin offloading their holdings, the market would likely experience a significant downturn. Especially as this would likely trigger retail holders to begin offloading their bitcoin too. Conversely, if these institutions continue to buy, the BTC price could surge dramatically, particularly if they maintain their positions as long-term holders. This dynamic underscores the double-edged nature of institutional involvement in Bitcoin, as it slowly then suddenly possesses a greater influence on the asset.

Conclusion

Institutional investment in Bitcoin has both positive and negative aspects. It brings legitimacy and capital that could drive Bitcoin prices to new heights, especially if these entities are committed long term. However, the concentration of Bitcoin in the hands of a few institutions could lead to heightened volatility and significant downside risk if these players decide to exit their positions.

For a more in-depth look into this topic, check out a recent YouTube video here:

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

amoxil online buy – amoxicillin online buy brand amoxicillin

amoxicillin for sale – cheap amoxicillin tablets purchase amoxil generic

fluconazole 100mg tablet – https://gpdifluca.com/# diflucan 200mg cheap

fluconazole 200mg price – https://gpdifluca.com/# fluconazole for sale

escitalopram for sale online – generic lexapro 10mg escitalopram 10mg price

generic cenforce 100mg – https://cenforcers.com/# buy cenforce pills

cenforce 50mg us – click order cenforce 100mg online

how long does tadalafil take to work – https://ciltadgn.com/# how long does it take for cialis to take effect

cialis tadalafil 20 mg – cialis one a day with dapoxetine canada buy cialis without prescription

cialis coupon 2019 – https://strongtadafl.com/# cialis 5mg price comparison

tadalafil online canadian pharmacy – safest and most reliable pharmacy to buy cialis cialis free trial voucher 2018

ranitidine over the counter – buy zantac 150mg sale zantac oral

order cheap generic viagra – https://strongvpls.com/# 50 or 100mg viagra

viagra buy over counter – https://strongvpls.com/# buy viagra uk online

Thanks recompense sharing. It’s first quality. https://buyfastonl.com/isotretinoin.html

Thanks on sharing. It’s outstrip quality. order neurontin 100mg

The thoroughness in this piece is noteworthy. nolvadex pill

More peace pieces like this would urge the интернет better. prednisolone para que sirve

More posts like this would persuade the online elbow-room more useful. https://ursxdol.com/cialis-tadalafil-20/

Thanks towards putting this up. It’s evidently done. https://ursxdol.com/levitra-vardenafil-online/

This is a theme which is in to my callousness… Numberless thanks! Faithfully where can I find the phone details an eye to questions? https://prohnrg.com/product/diltiazem-online/

Greetings! Jolly serviceable advice within this article! It’s the scarcely changes which will turn the largest changes. Thanks a portion for sharing! https://prohnrg.com/product/priligy-dapoxetine-pills/

With thanks. Loads of knowledge! aranitidine.com

This is a topic which is in to my callousness… Diverse thanks! Faithfully where can I lay one’s hands on the contact details for questions? https://aranitidine.com/fr/viagra-professional-100-mg/

With thanks. Loads of erudition! https://ondactone.com/product/domperidone/

This website exceedingly has all of the information and facts I needed about this thesis and didn’t comprehend who to ask. https://ondactone.com/product/domperidone/

Greetings! Very useful advice within this article! It’s the petty changes which choice turn the largest changes. Thanks a a quantity for sharing!

levaquin 500mg usa

The depth in this serving is exceptional.

zofran order

More delight pieces like this would urge the web better. http://www.01.com.hk/member.php?Action=viewprofile&username=Tllnck

This website absolutely has all of the bumf and facts I needed adjacent to this thesis and didn’t positive who to ask. http://anja.pf-control.de/Musik-Wellness/member.php?action=profile&uid=4705

where can i buy dapagliflozin – janozin.com forxiga price

order dapagliflozin 10 mg for sale – https://janozin.com/ forxiga online buy

purchase orlistat sale – janozin.com order xenical 120mg generic

buy xenical medication – cost xenical order xenical 60mg online

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thanks for sharing. It’s outstrip quality. http://mi.minfish.com/home.php?mod=space&uid=1420937

This website really has all of the tidings and facts I needed adjacent to this case and didn’t positive who to ask. http://zqykj.cn/bbs/home.php?mod=space&uid=303351

You can protect yourself and your dearest by being alert when buying pharmaceutical online. Some druggist’s websites manipulate legally and sell convenience, solitariness, cost savings and safeguards to purchasing medicines. buy in TerbinaPharmacy https://terbinafines.com/product/zetia.html zetia

You can keep yourself and your family by way of being cautious when buying pharmaceutical online. Some druggist’s websites manipulate legally and sell convenience, reclusion, rate savings and safeguards to purchasing medicines. buy in TerbinaPharmacy https://terbinafines.com/product/elavil.html elavil

This is the tolerant of post I unearth helpful. TerbinaPharmacy

I couldn’t hold back commenting. Profoundly written! acheter levitra livraison rapide

I’ll certainly bring back to review more.

With thanks. Loads of expertise!

**mitolyn official**

Mitolyn is a carefully developed, plant-based formula created to help support metabolic efficiency and encourage healthy, lasting weight management.

gambling sites

best online casino usa real money

jackpot party casino 4 hour bonusly

betmgm Connecticut betmgm New Hampshire betting mgm

betmgm Р Рђ betmgm-play betmgm Missouri

Enjoy betting on sports and casino games. crown coins casino login guarantees fairness and variety. Join the community of winners!

Dive deep into themed adventures and bonus quests. crown coins casino app offers quest-based rewards for engaging play. Quest, win, and repeat!

Sweet Bonanza is the slot that turns sugar into serious cash prizes. Pay sweet bonanza mobile anywhere on the reels, multiply with bombs, and trigger free spins for even bigger thrills. Play now and feel the rush!

Sweet Bonanza combines eye-popping visuals with high-volatility excitement that sweet bonanza high volatility keeps players coming back. Free spins round loaded with up to 100x multipliers = pure adrenaline. Join the candy craze!