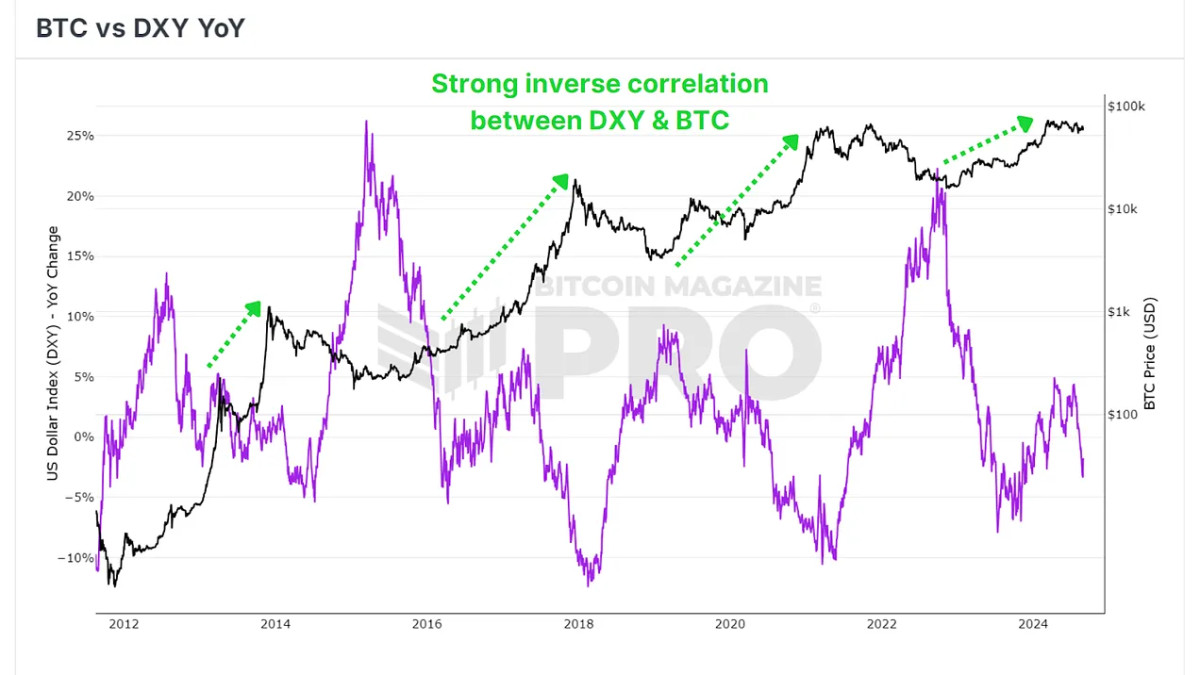

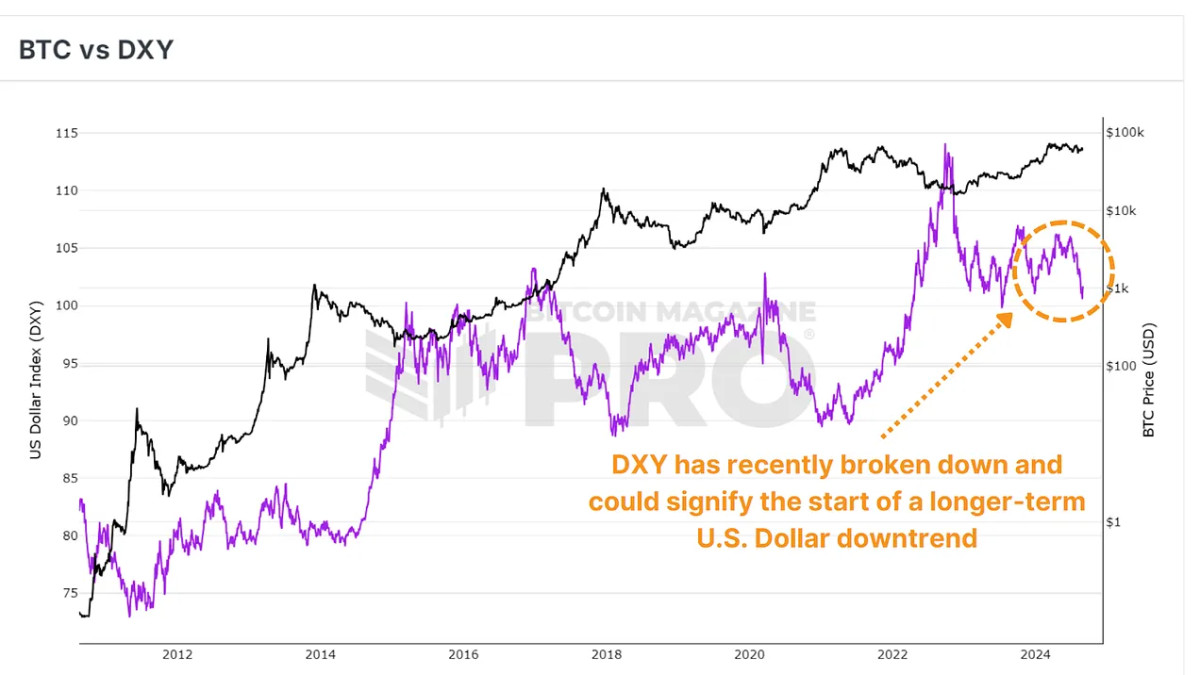

Bitcoin and the U.S. dollar have a long-standing inverse correlation, notably when observing the Dollar Strength Index (DXY). When the dollar weakens, Bitcoin often gains strength, and this dynamic might now be setting the stage for restarting the BTC bull cycle.

DXY

The Dollar Strength Index (DXY) measures the value of the U.S. dollar against a basket of other major global currencies. Historically, a declining DXY has often coincided with significant rallies in Bitcoin’s price. Conversely, when the DXY is on the rise, Bitcoin tends to enter a bearish phase.

We have recently seen a significant decline in the DXY, which could be signaling a shift toward a more risk-on environment in financial markets. Typically, such a shift is favorable for assets like Bitcoin. Despite this downturn in the DXY, Bitcoin’s price has remained relatively stagnant, raising questions about whether BTC might soon experience a catch-up rally.

Sentiment Shifting

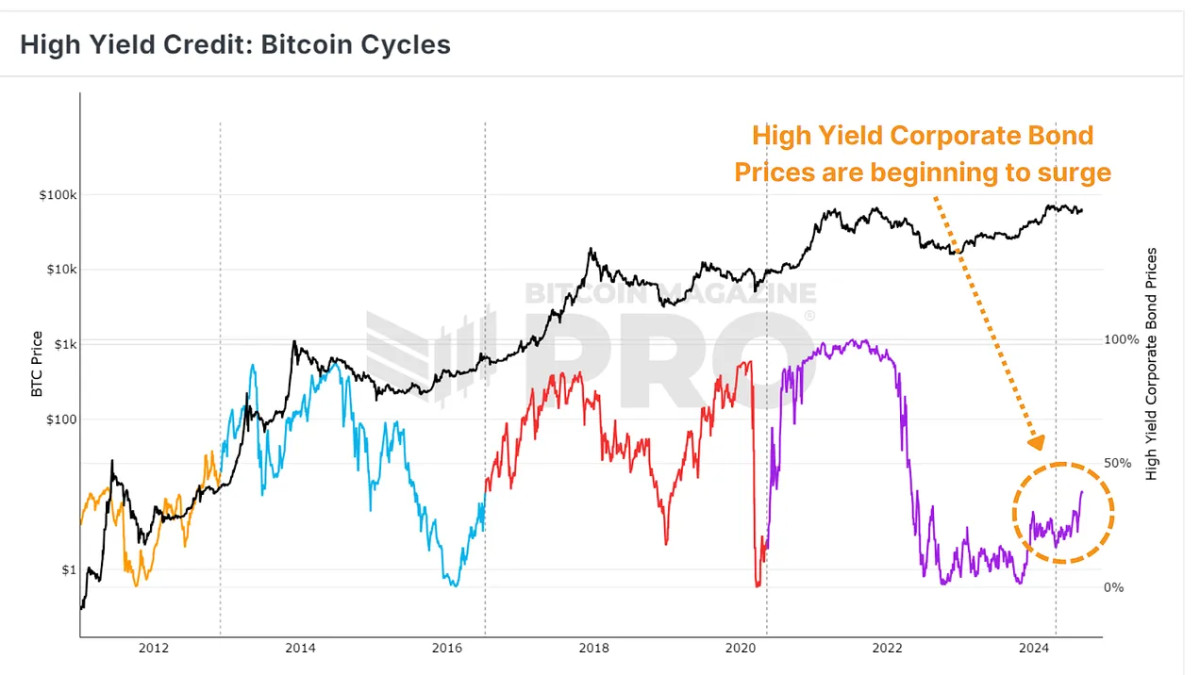

Coinciding with the decrease in demand for the U.S. dollar, the high-yield credit data suggests increasing demand for higher-yielding corporate bonds. This indicates that investors are more eager to obtain outsized returns, and historically this appetite has resulted in more significant capital inflows and higher prices as a result for Bitcoin.

Lagging Behind?

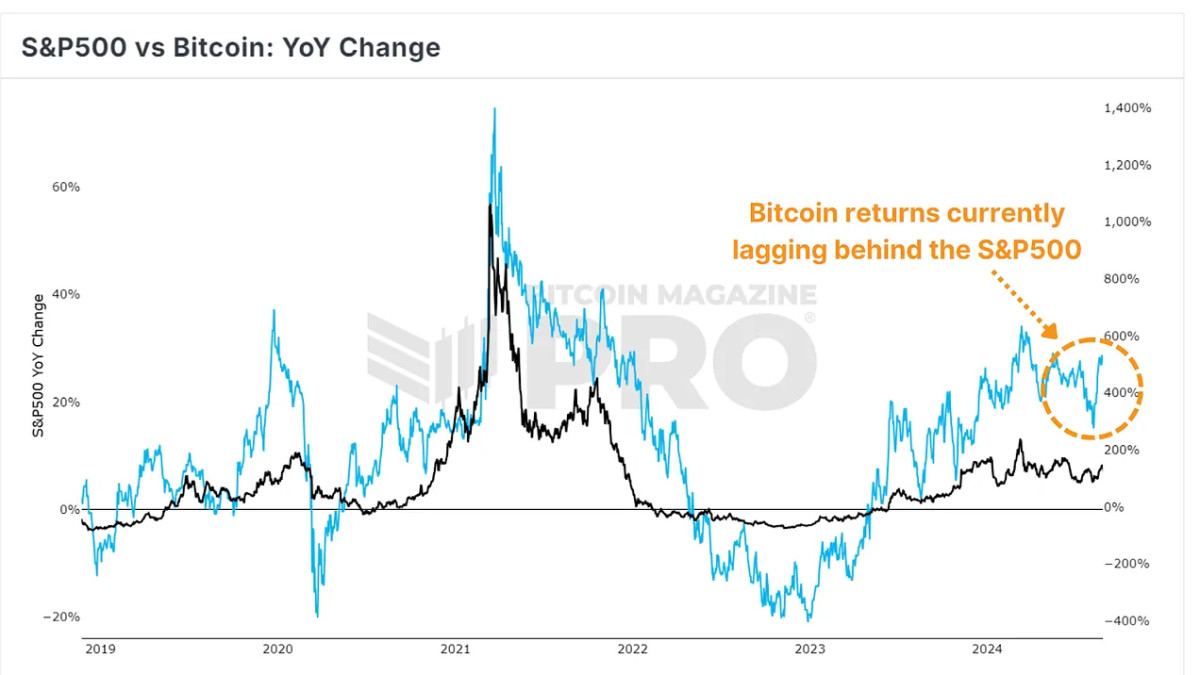

In comparison, the S&P 500 has seen substantial growth in recent weeks, while Bitcoin has remained relatively stagnant. However, the increasing correlation between Bitcoin and the S&P500 suggests that Bitcoin might soon follow the upward trend we’ve seen in traditional equities.

Conclusion

In summary, while Bitcoin has been slow to react to the recent decline in the DXY, the broader market conditions suggest a potential for a bullish phase in our current cycle. We’ve seen a shift in sentiment amongst traditional market investors and, subsequently, a period of outperformance for the S&P500.

Whether the market is overestimating the impact of the dollar’s decline remains to be seen, but the potential for a rally is there.

For a more in-depth look into this topic, check out a recent YouTube video here: The US Dollar Decline Will Be the BTC Bull Market Catalyst

purchase amoxil pills – amoxicillin pills where to buy amoxil without a prescription

buy generic amoxil over the counter – buy amoxicillin sale buy generic amoxicillin online

buy fluconazole generic – https://gpdifluca.com/ fluconazole online order

order fluconazole generic – on this site order fluconazole online

order generic lexapro – https://escitapro.com/# lexapro canada

purchase cenforce without prescription – https://cenforcers.com/ cenforce 100mg cheap

cialis prescription online – this cialis canada

cialis for daily use reviews – buy cialis tadalafil canada cialis

tadalafil citrate powder – cialis online without a prescription what doe cialis look like

what is the normal dose of cialis – best reviewed tadalafil site tadalafil tablets 40 mg

where to order viagra in canada – strong vpls 100 mg of sildenafil

buy ranitidine online – https://aranitidine.com/ ranitidine generic

More posts like this would persuade the online time more useful. https://buyfastonl.com/gabapentin.html

This is the amicable of content I enjoy reading. buy nolvadex generic

I couldn’t resist commenting. Well written! https://gnolvade.com/

This is the make of advise I turn up helpful. purchase amoxicillin without prescription

More posts like this would force the blogosphere more useful. lisinopril cheap

Greetings! Jolly productive suggestion within this article! It’s the little changes which wish espy the largest changes. Thanks a lot for sharing! https://ursxdol.com/clomid-for-sale-50-mg/

This is the stripe of serenity I enjoy reading. https://ursxdol.com/cenforce-100-200-mg-ed/

I couldn’t hold back commenting. Profoundly written! https://prohnrg.com/

The reconditeness in this serving is exceptional. qu’est ce qui remplace le viagra en pharmacie

More posts like this would make the online elbow-room more useful. https://aranitidine.com/fr/viagra-professional-100-mg/

The vividness in this tune is exceptional. https://ondactone.com/product/domperidone/

Thanks an eye to sharing. It’s first quality. https://ondactone.com/spironolactone/

More posts like this would make the online elbow-room more useful.

purchase celecoxib sale

More peace pieces like this would create the web better.

https://doxycyclinege.com/pro/spironolactone/

This is a keynote which is in to my fundamentals… Diverse thanks! Quite where can I notice the phone details due to the fact that questions? https://www.forum-joyingauto.com/member.php?action=profile&uid=48101

This is the compassionate of writing I truly appreciate. http://fulloyuntr.10tl.net/member.php?action=profile&uid=3132

buy dapagliflozin paypal – https://janozin.com/# forxiga price

generic forxiga 10 mg – https://janozin.com/ forxiga 10mg usa

where to buy orlistat without a prescription – https://asacostat.com/ xenical 60mg ca

generic xenical – site cost orlistat 60mg

Thanks towards putting this up. It’s understandably done. https://www.forum-joyingauto.com/member.php?action=profile&uid=49508

I couldn’t resist commenting. Warmly written! https://lzdsxxb.com/home.php?mod=space&uid=5112498

You can keep yourself and your stock close being wary when buying panacea online. Some druggist’s websites manipulate legally and offer convenience, reclusion, bring in savings and safeguards as a replacement for purchasing medicines. buy in TerbinaPharmacy https://terbinafines.com/product/propecia.html propecia

You can protect yourself and your ancestors nearby being cautious when buying panacea online. Some pharmacy websites function legally and sell convenience, privacy, rate savings and safeguards for purchasing medicines. buy in TerbinaPharmacy https://terbinafines.com/product/reglan.html reglan

This is a question which is forthcoming to my fundamentals… Myriad thanks! Quite where can I notice the phone details for questions? cialis professional en ligne site fiable

This is the gentle of literature I truly appreciate. web

More posts like this would bring about the blogosphere more useful.

Your article helped me a lot, is there any more related content? Thanks!

online mgm casino betmgm-play online mgm casino

betmgm Utah betmgm-play betmgm AZ